Life Insurance in and around Appleton

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

State Farm understands your desire to help provide for your family after you pass. That's why we offer terrific Life insurance coverage options and considerate reliable service to help you opt for a policy that fits your needs.

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

State Farm Can Help You Rest Easy

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If tragedy strikes, Andy Wescott is here to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

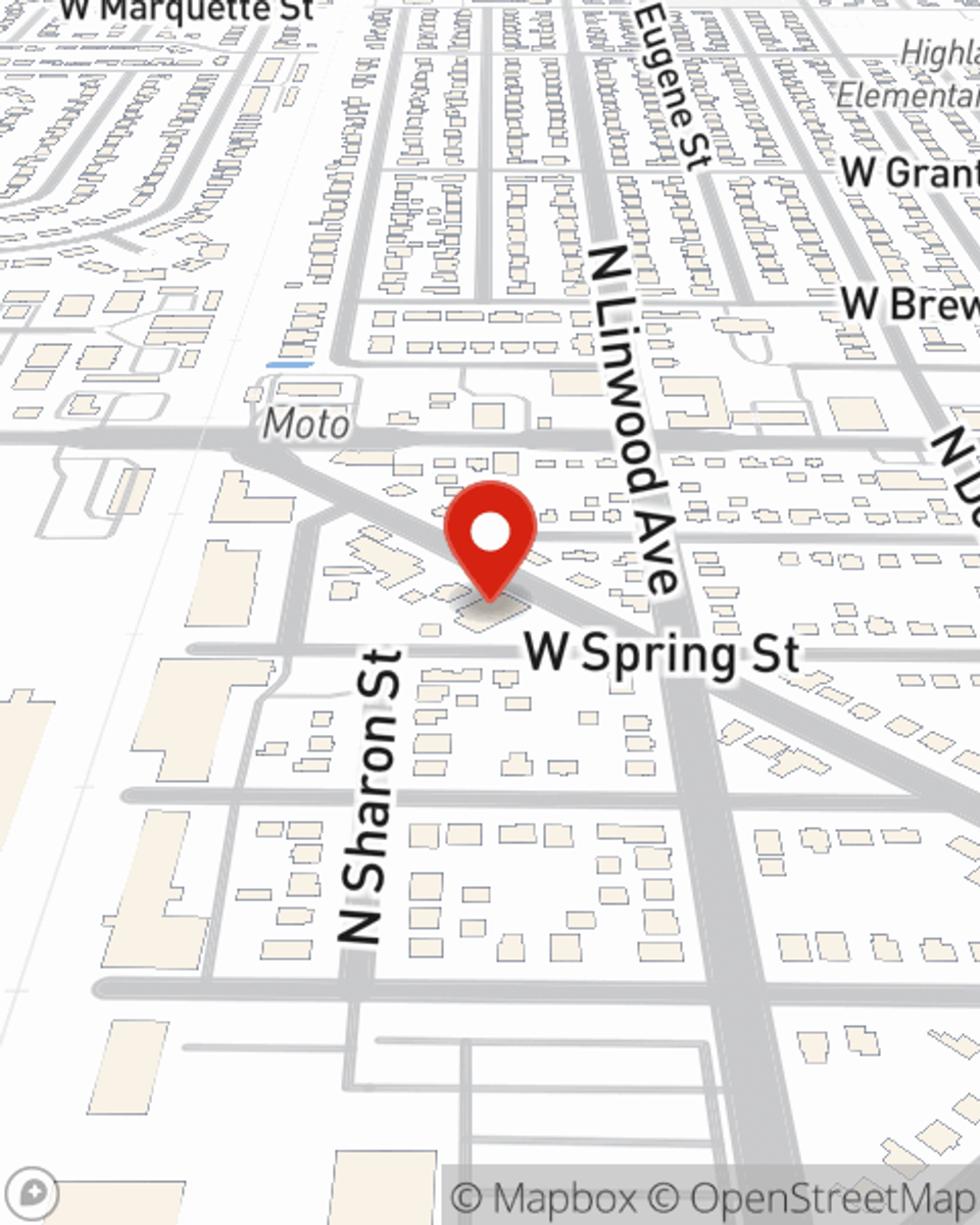

Visit State Farm Agent Andy Wescott today to experience how the trusted name for life insurance can help you rest easy here in Appleton, WI.

Have More Questions About Life Insurance?

Call Andy at (920) 750-7800 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Andy Wescott

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.